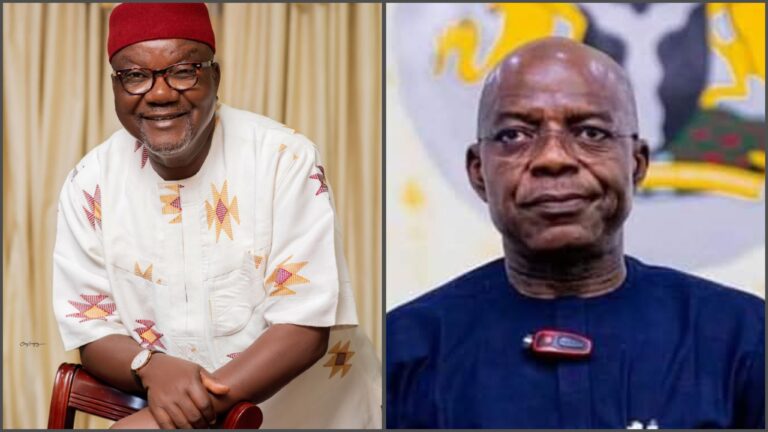

DRACONIAN TAXATION; RUTHLESS ENFORCEMENT IN ABIA STAT

Just recently, business owners in Abia state have witnessed hike in their taxes and attendant daily harassment from state tax authorities.

Tax is a civic responsibility, but it comes with a corresponding obligation on the part of government. Abia has long remained among the lower-tier states in terms of its potential to grow internally generated revenue (IGR).

This administration came into office with high expectations, promising to raise IGR to about N5 billion monthly. However, more than two years after assuming office, they are still trailing behind the performance of the last administration. The highest they ever generated was N1.8 billion until they started including school fees, students registration fees etc and hospital bills, which pushed the figure up to N3.8 billion.

The government regrettably became complacent because of ballooned monthly allocations, especially with the unexpected N38 billion they receive due to institutional reforms introduced the APC-led Federal Government.

Recently, the state signed an MOU with Access Bank to increase Abia’s IGR to N6 billion, using N4 billion as the baseline. This deal automatically activates a 15% payment clause in favor of Access Bank on achievement of agreed milestone.

Instead of expanding the tax net introducing new and innovative revenue windows, Access Bank’s consultants have chosen the easiest route, which is tightening the noose on existing taxpayers, to the detriment and strangulation of Abians.

The Abia State Revenue Board recently increased all informal taxes over 100%, with ASEPA levies skyrocketing more than 500%. A hospital that used to pay N24k annually is now forced to pay N1.3 million. Gas stations that previously paid N48k are now compelled to pay N450 million.

Keke drivers were initially charged N700, reduced to N500, and later N350 after four days of protest, yet the government has vowed to revisit the levy. Bus drivers were not spared as their daily ticket was doubled from N500 to N1,000.

Only yesterday, elderly and impoverished women were forced to protest at Ahia Nkwo Abaiyi over the imposition of a N300 daily ticket on petty traders, who are poor women that leave home each day with vegetables to sell, often returning unsold before sunset.

A closer look reveals a government that is insensitive and lacks empathy for the very people it leads. Workers are not left out; PAYE deductions are done arbitrarily, with no transparency. No Abia worker today can plan with their take-home pay, especially amidst the non-implementation of the new minimum wage in some units in local government System.

There are no safety nets for workers and small business /entrepreneurs. While the payment of tax is encouraged, moderation is critical, especially in this harsh economic climate.

In states where taxes are relatively high, governments cushion the effect with social provisions. For example, Enugu State introduced 200 CNG buses to subsidize transportation. Education is prioritized, with over 260 smart schools offering free education, free feeding, free uniforms, and computers. Between June 2023 and December 2024, Abia reportedly spent N72.5 billion on school renovations, yet the people cannot point to tangible results.

The health sector tells the same story. Enugu State has a functional health insurance scheme and has gone further to insure over 9,000 farmers against losses.

In Enugu, people can relate to visible development across sectors. But in Abia, the question remains, “what projects swallowed the N750 billion in the 2025 budget, that additional N150 billion supplementary budget was needed?” Where are the projects that our taxes are funding?

The Abia State Government must understand that Abians demand accountability, not just the imposition of harsh taxes enforced consultants who are only concerned about hitting the N6 billion target, without considering the devastating effect on the people.

Ekwedike.